Money & Speed: Inside the Black Box is a thriller based on actual events that takes you to the heart of our automated world. Based on interviews with those directly involved and data visualizations up to the millisecond, it reconstructs the flash crash of May 6th 2010: the fastest and deepest U.S. stock market plunge ever. http://youtu.be/aq1Ln1UCoEU _______________

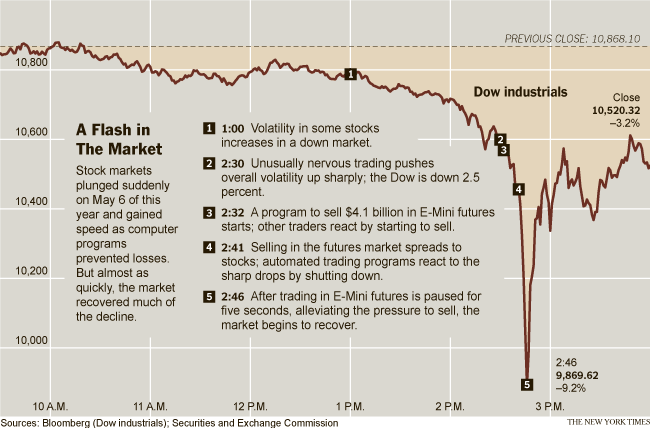

They call it “the Flash Crash”. On the 6th of May, 2010 automatic stocktrading started to become erratic, untill finally the prices of stock collapsed. A nosedive never seen before. Amazingly enough the prices recovered fast and what remains is a mystery. A mystery that took place in the “Black box” of automated trading.

20 to 30% (probably even more) of stocktrade is done automatically. Banks, investors and traders use computer software, which takes conclusions, buying or selling, in milli-seconds. The computers are programmed with so called “algorythms”. These are very complicated formula, that use incoming data, f.i. fluctuations in stockprices around the world, to feed the algorythm. Programmers seek for “zero-time”, which means immidiate input and processing of the incoming data. The algorythms are evolving, they adapt and change internally and they grow. These algorythmic computers are maybe the closest man has come to artificial intlligence, including a free will.

The nanoseconds it taakes, a computer can place tens of thousands of buying or selling orders. Experts call it “the Black Box”, implying that we don't know anything of what is happening “inside” the algorythm. The “Flash Crash” stays a mystery.

In these cases “quid bono”, who benefits, is perfect tool for analysis? At least those “compurer-algo's” who baught Apple or Proctor & Gamble stock at the right moment. A hughe profit in a microsecond. And smaller “flash-crashes” appear regularly and can only be noted, when you analyse, and of course always afterwards, the transactions on a micro-second level.

Is it a war between the algorythms? Or are programmers creating a “super-algorythm”, one that conquers and controls all computerized trading? Computers do, what they are told and you cannot blame it on the soft-ware. The “Flash Crash” was intentional and it will “flash” again. And only a few people know, what actually is happening and in their arrogance and ignorance, they belief, that it will stay unnoticed and hidden. We have entered a period of ethical cleansing. Everything will be revealed. The word becomes flesh.

Geen opmerkingen:

Een reactie posten